Tariff explanation and management

Following is an article about tariff explanation and management. Each matter consist of bills, these bills contains different items which is called tariffs. Cost Consulting currently provide up to date tariffs for the following courts.

- HIGH COURT

- MAGISTRATES COURT SCALE B

- MAGISTRATES COURT SCALE C,

- MAGISTRATES COURT SCALE A

- S.A. APPEAL COURT

- REGIONAL COURT

Tariff explanation and management

Whenever new tariffs are released, Cost Consulting updates all default tariffs across the system. Keep in mind that all out of the box tariffs will be appended to when new tariffs are released. Any custom tariffs added to the existing courts will not be transferred to the new tariff period.

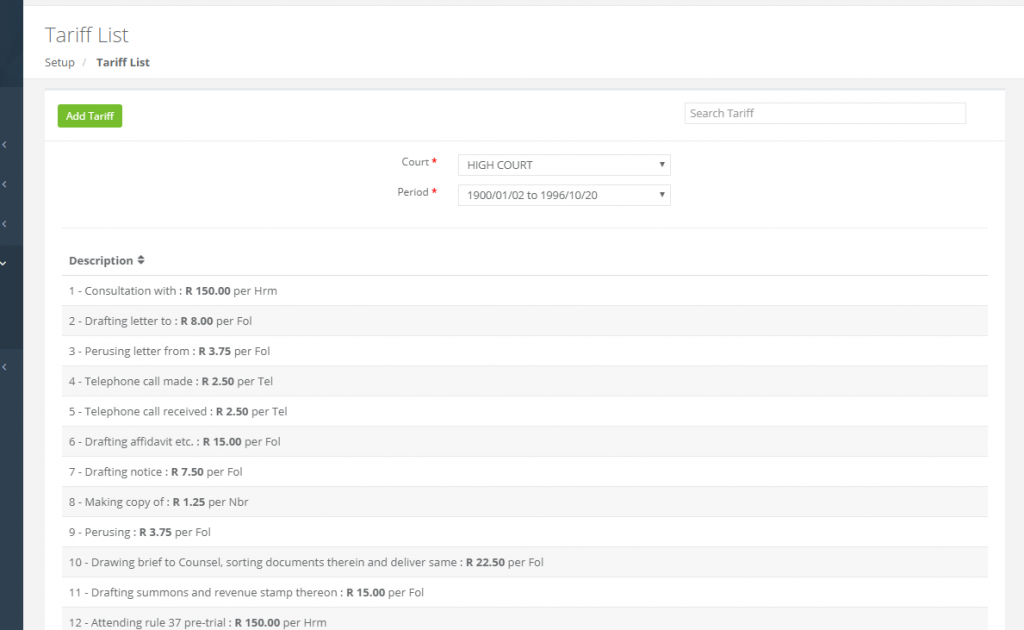

The tariff section can be accessed by navigating to Setup->Tariffs. A selection can be made for a specific court and then time period. The period is price scales for certain tariff periods and all tariff items can be viewed by using both courts and time period. Selecting both will immediately give you a list of tariffs.

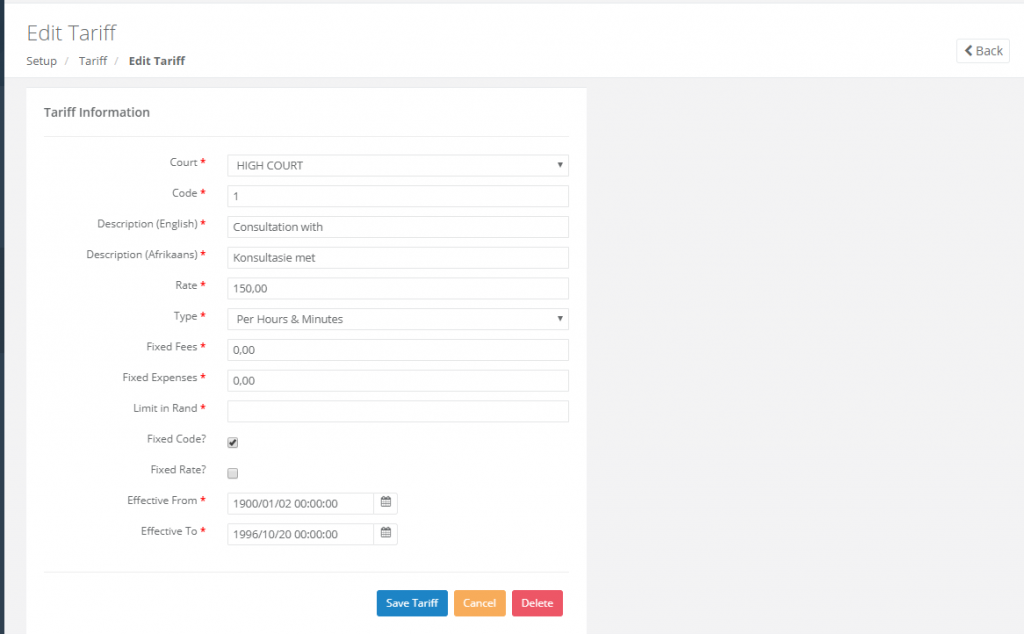

Tariffs can be modified by selecting the item from the list. This will open the selected tariff and any data can be modified. Keep in mind that whatever data you modify on the out of the box items, will not be replicated to new time periods.

The tariff item contains the following fields:

- Court

- Selection of courts, added under Manage Courts

- Code

- Tariff code are used to speed up the taxation process in order to talk about codes instead of full tariff description

- Description and Rate

- Description and rate for the specific tariff

- Type

- Currently we allow for certain types of tariffs to be added. Each type can be used in accordance to it’s name.

- Phone

- Folio

- Page

- Number of Pages or Copies

- Units

- Kilometers

- Fixed Fees

- Currently we allow for certain types of tariffs to be added. Each type can be used in accordance to it’s name.

- Fixed Fees & Expenses

- Fixed fees and expenses for consultants

- Limit in Currency

- You can limit the maximum amount the tariff can use. Thus the tariff will never consume more than this amount.

- Fixed Code an Rate

- Select if this should be a fixed rate and code

- Effective Dates

- Effective dates will be used to set the date range this tariff should be displayed. Date ranges are linked to courts. In order to access a tariff, the matter needs to be in the selected court, and the bill item needs to be added to the specific date range.

In cases where you have lots of tariffs the search functionality can be used for the specific court and date range. Tariffs can be added by selecting Add Tariff. You can follow the same steps as when editing in order to create a new tariff.

Tariffs can only be deleted if they are not already used in other places for instance bills or matters.