Working with Matters

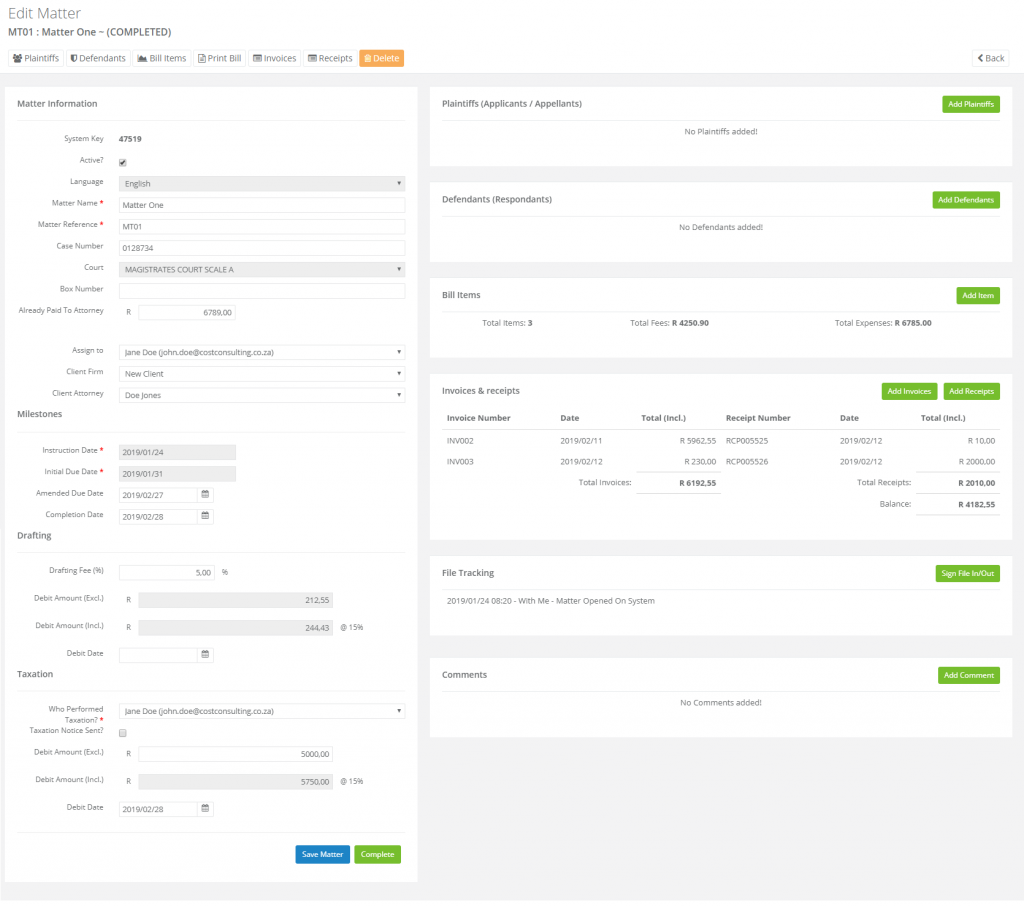

Working with matters on the Cost Consulting Platform allows you manage various aspects of a matter. Matters can be accessed via a user work-list, searching for matters and recent matters. Some reports also allow users to navigate to specific matters.

The matter dashboard consists of nine widgets or sections allowing the taxation consultant to perform duties very effectively.

In addition to the nine widgets, an action bar is also available on the main matter page, allowing the user to navigate to other key functions in the system.

Currently the action bar consists of the following items:

- Plaintiffs

- Defines the plaintiff list to be displayed on the bill of cost

- Defendants

- Defines the defendant list to be displayed on the bill of cost

- Bill Items

- Opens the bill of cost module allowing you to create the bill of cost items. Bill items and bill of costs are describe in more detail in our Creating and Printing Bills article.

- Print Bill

- Prints the billing items according to a predefined bill of cost template. You can learn more about printing bill of costs in our Creating and Printing Bills article.

- Invoices

- If the work has been completed, the user can generate an invoice for those work items. Invoice are covered in the Create Invoices and Receipts article.

- Receipts

- Matter receipts can be generated to link with completed invoices. Receipts are covered in the Create Invoices and Receipts article.

- Delete

- In some cases you will be able to delete matters depending on the totality of work done on the matter.

The nine different matter dashboard widgets:

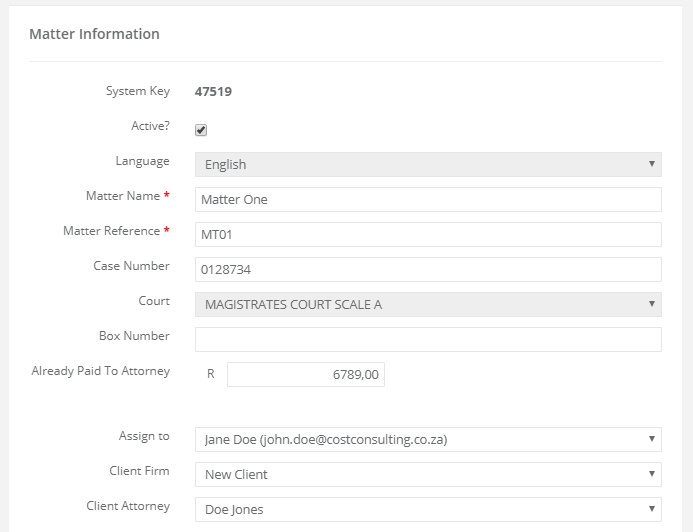

Matter Information

The first section of the matter dashboard contains general information of the matter. Some information completed when creating a matter can now be updated from here.

Matter Information

In addition the consultant will be able to enter the box number (whenever a value is entered it will display on the bill of costs) and the amount already paid to the attorney.

The matter can be moved to a different user within the company and if required the cost consultant can move the matter to a different client firm and attorney.

Note: No fields will auto save when making changes, thus you will have to submit the form by clicking on “Save Matter” at the bottom of the matter page.

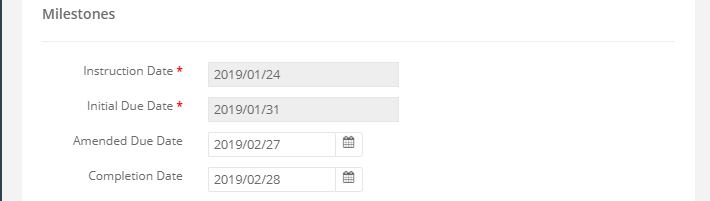

Milestones

Milestones allows the cost consultant to track the life-cycle of the matter from instruction to completion.

Cost Consulting allows the consultant to complete the following fields:

- Instruction Date

- The date on which instruction was received

- Due Date

- The initial due date of when the client expects the matter to be completed and billed for

- Amended Due Date

- If for some reason the due date of the matter changes the consultant can amend the due date by completing this field to reflect the next due date

- Completion Date

- Represents the date that the matter has been completed. Once completed the matter will no longer be visible on the work-list

There are 2 ways in which a user can complete a matter

- Enter a date into the completion field and save the matter

- Complete the matter by clicking on the Complete matter button in which case the system will automatically populate the current date into the completion date field and save the matter

Matter Drafting

Drafting of consultant fees can be accomplished by completing the drafting section on the matter dashboard.

The drafting section consists of the following fields:

- Drafting Fee (%)

- The percentage to be used to calculate the total drafting fee

- Debit Amount (Excl.)

- Read-Only field to display the current drafting amount, calculated from the bill of costs expenses

- Debit Amount (Incl.)

- Read-Only field to display the current drafting amount, calculated from the bill of costs expenses

- Debit Date

- The date that the drafting work was completed on this specific matter

Note: VAT percentages will only be visible if the company profile contains a valid VAT number. If the company do not have a VAT number the system will use 0% as VAT

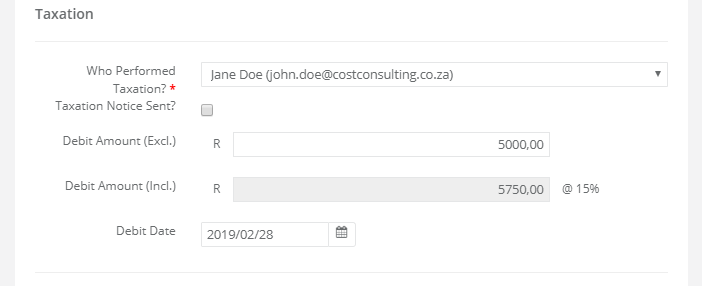

Taxation

The taxation section is used to complete taxation amounts and dates relating to the Taxation of bill efforts. These can later be reviewed on report a report level.

Taxation Section

Taxation can be completed and amended by using the taxation section on the matter dashboard. The following fields are available under the taxation section.

- Who performed taxation

- Specifies which cost consultant was responsible for performing the work related to the taxation of the current matter. This can either be the same person as the owner of the matter or it can be a different person. This typically caters for the scenario where the cost consultant is responsible for all the drafting work and another consultant is responsible for taxation only.

- Taxation notice sent

- Selecting this option will allow the consultant to select a date on which the taxation notice was send as well as a time

- Debit Amount (Excl.)

- The fee that will be charged for work related to the taxation of the matter excluding VAT

- Debit Amount (Incl.)

- The fee that will be charged for work related to the taxation of the matter including VAT

- Debit Date

- The date that the account was debited to the client for the taxation of the bill. This field is automatically populated when generating an invoice.

Note: VAT percentages will only be visible if the company profile contains a valid VAT number. If the company do not have a VAT number the system will use 0% as VAT

Plaintiffs and defendants

Managing of plaintiff and defendant data will appear on the printed bill of costs. The system allows the consultant to add defendants and plaintiffs from the matter dashboard.

The consultant will be able to add, delete and modify details of plaintiffs and defendants.

Plaintiff and Defendants

Billing

The billing summary provides a high level overview of the compiled bill items. From here you can navigate to the bill of costs section where you will be creating bill items. Bill of costs are explained in more detail in our Creating and Printing Bills article.

File Tracking

File tracking is currently only a note based system. You can track documents by completing the file tracking of documents. Tracking of files cannot be deleted once added. This keeps a secure record of all movements of the file.

Tracking of files

Comments

Consultants can add unlimited comments to a matter. Comments are visible for all users from the same company. Comments can also be deleted by selecting the comment from the list.

Matter Comments

You might be interested in the powerful reports you can generate using Cost Consulting.