Setting up your company information

Setting up your company information is one of the first things you need to do to take full advantage of taxation on the Cost Consulting platform. It is easy to access the company profile page by going to Account->My Company.

Company Information

The company profile page consists of three sections:

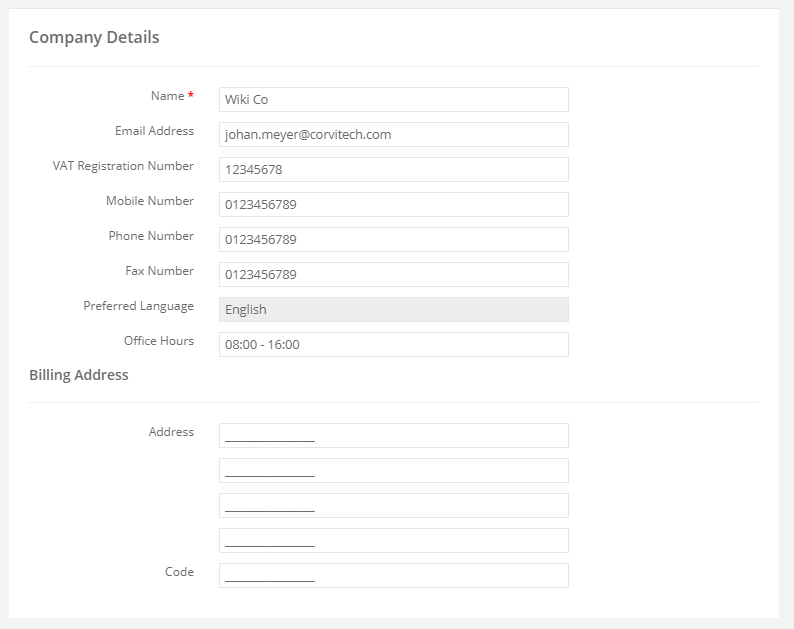

- Company Details

- Contains more information regarding your company as well as billing address, VAT registration number and office hours

- Company Header and Footers

- Headers and footers being used by invoices and receipts

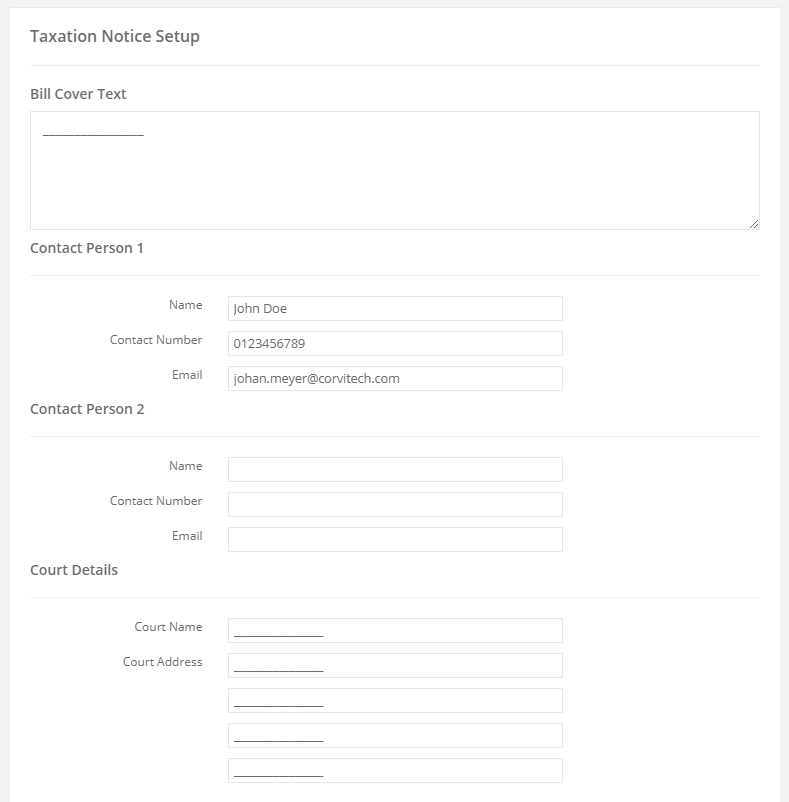

- Taxation Notice Setup

- When printing bills, some of the information you complete on the company profile get’s used on the bill of costs.

Company Details

General information regarding your company. The information provided in these fields will be used in the bill of costs. VAT will only be calculated if a valid VAT number is provided.

General Information

Company Header and Footers

Images uploaded to the headers and footers will display on the invoices you can generated for firms and clients. If you would like no header or footer kindly upload a blank image. Additional information can also be added to the footer section of invoices.

Taxation Notice Setup

By providing taxation details will allow the platform to complete the printing of the bill of costs more thoroughly. When you leave items empty the system will automatically complete them with empty lines when printing the bill of costs

Note: My company menu item was moved in the latest version from the setup category to the account category.